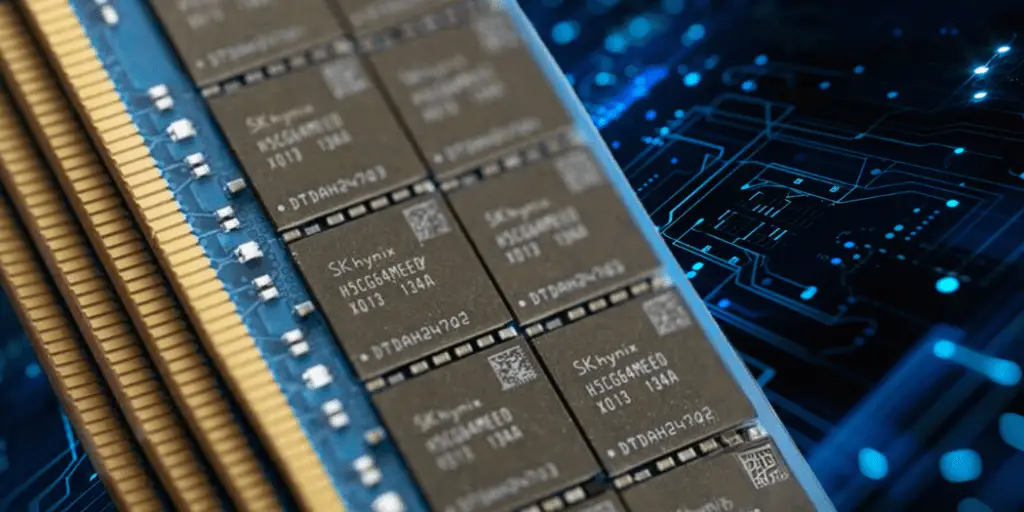

Leading memory chip manufacturer based in South Korea, regarding the near-complete depletion of its high-bandwidth memory chip inventory for 2024.

The soaring demand anticipated for 2025 marks a significant development in the semiconductor industry, particularly within artificial intelligence chipsets.

This underscores the rapidly expanding landscape of AI services and the critical role that advanced chip technologies play in powering these services.

SK Hynix’s insights glimpse the intensifying competition among major players like Micron and Samsung Electronics, all vying to meet the surging demand for ultra-high-performance chips essential for AI applications.

The impending scarcity of HBM Chips in AI Industry amplifies the urgency for diversified supply chains among AI chip purchasers to safeguard operating margins amidst this heightened demand.

HBM Chips in AI Industry

SK Hynix’s statement reflects the unprecedented demand for HBM chips driven by the proliferation of AI services. The surge in demand outstrips current supply capabilities, leading to a near-complete depletion of available inventory.

Micron, a key competitor, has similarly reported sold-out HBM chips for 2024, with most of its 2025 supply already allocated. This scarcity underscores the industry-wide challenge of meeting the escalating demand for high-performance chips.

SK Hynix, Micron, and Samsung Electronics are at the forefront of the HBM chip market, competing to cater to the burgeoning demand from AI chip manufacturers such as Nvidia.

The withdrawal of SK Hynix as the sole supplier of HBM chips to Nvidia in March underscores the strategic imperative for diversifying supply chains, a move aimed at bolstering operational resilience and mitigating supply chain risks.

SK Hynix’s introduction of its latest 12-layer HBM3E chip signifies a significant leap in chip technology, offering enhanced performance and efficiency compared to previous generations.

Samsung Electronics plans to produce its own HBM3E 12-layer chips, further exemplifying the industry’s commitment to innovation and meeting the evolving demands of AI infrastructure.

The exponential growth in data and AI model sizes is projected to sustain the upward trajectory of the HBM market. SK Hynix anticipates annual demand growth of approximately 60% in the mid-to long-term.

Industry analysts foresee a substantial increase in the proportion of chips dedicated to AI applications, such as HBM and high-capacity DRAM modules, reflecting the growing importance of these technologies in driving AI innovation.

Industry Analysis

The announcement by SK Hynix regarding the soaring demand for HBM chips offers valuable insights into the evolving landscape of the semiconductor industry, particularly within the context of artificial intelligence infrastructure.

HBM chips play a pivotal role in powering AI chipsets, offering unparalleled performance and efficiency for handling the intensive computational workloads associated with AI applications.

As AI continues to permeate various sectors, from autonomous vehicles to healthcare, the demand for high-performance chips like HBM is poised for exponential growth.

SK Hynix’s strategic investments, including constructing an advanced chip packaging plant in the U.S. and a new DRAM chip factory in South Korea, underscore the company’s commitment to meeting the surging demand for HBM chips.

These investments expand SK Hynix’s production capacity and signal its proactive approach to capitalizing on emerging opportunities in the AI semiconductor market.

The revelation that SK Hynix was, until recently, the sole supplier of HBM chips to Nvidia highlights the risks associated with overreliance on a single supplier.

Major AI chip purchasers, recognizing the importance of mitigating supply chain risks, are increasingly diversifying their supplier base to ensure continuity of operations and safeguard operating margins.

The introduction of SK Hynix’s latest 12-layer HBM3E chip represents a significant technological advancement, offering superior performance and efficiency compared to previous iterations.

Samsung Electronics’ entry into the market with its HBM3E 12-layer chips further intensifies competition. It underscores the industry’s relentless pursuit of innovation.

Projections indicate sustained growth in the HBM market, fueled by the escalating demand for AI services and the ever-expanding volumes of data.

The increasing adoption of AI across diverse industries and advancements in AI hardware are expected to drive robust demand for high-performance chips like HBM in the coming years.

Technological Advancements

SK Hynix’s unveiling of its latest 12-layer HBM3E chip represents a significant chip design and functionality leap forward. This new iteration offers enhanced performance, increased bandwidth, and improved energy efficiency compared to previous generations.

The transition from 8-layer to 12-layer HBM3E chips signifies a substantial increase in data processing capabilities, aligning with the escalating demands of AI workloads.

The advancements in HBM chip design translate into tangible improvements in performance and efficiency, enabling AI chipsets to handle increasingly complex computational tasks with greater speed and precision.

Higher bandwidth and reduced power consumption improve system performance, facilitating faster data processing and more efficient utilization of computational resources.

The introduction of SK Hynix’s 12-layer HBM3E chip intensifies competition in the market, driving innovation and pushing the boundaries of chip technology.

Competitors like Samsung Electronics, with their plans to produce HBM3E 12-layer chips, are also contributing to the technological advancements in the HBM chip sector, fostering a climate of innovation and continuous improvement.

The technological advancements in HBM chips have profound implications for AI infrastructure, enabling the development of more powerful and efficient AI systems.

These advancements pave the way for deploying AI applications across diverse industries, from autonomous vehicles and healthcare to finance and manufacturing, driving innovation and transformative change.

As the demand for AI services continues to surge and AI workloads become increasingly complex, further advancements in HBM chip technology are anticipated.

Future iterations of HBM chips are expected to offer even higher performance, bandwidth, and energy efficiency, enabling the realization of more sophisticated AI applications and services.

Technological advancements in HBM chips are revolutionizing the semiconductor industry, particularly within AI infrastructure.

These advancements enhance performance and efficiency, fuel innovation, and drive the development of transformative AI applications across various sectors.

Future Projections

High-bandwidth memory hip market is shaped by a confluence of factors, including the escalating demand for artificial intelligence services, advancements in chip technology, and evolving industry dynamics.

The exponential growth in data volumes and the proliferation of AI applications are expected to drive sustained demand for HBM chips in the coming years.

As AI workloads become increasingly complex and data-intensive, the need for high-performance memory solutions like HBM will continue to rise, underpinning market growth.

Industry projections indicate robust annual demand growth for HBM chips, with estimates hovering around 60% in the mid-to-long term.

This growth trajectory underscores the critical role of HBM chips in advancing AI infrastructure and supporting the deployment of increasingly sophisticated AI applications.

HBM chips are poised to capture a larger share of the overall memory market, driven by their unique performance, bandwidth, and energy efficiency advantages.

By 2028, the portion of chips dedicated to AI applications, including HBM and high-capacity DRAM modules, is projected to account for a significant proportion of the overall memory volume, signalling the growing importance of AI in shaping the memory chip landscape.

Ongoing advancements in HBM chip technology are anticipated to further enhance performance, bandwidth, and energy efficiency, enabling the development of more powerful and efficient AI systems.

Future iterations of HBM chips may incorporate innovations such as increased layer counts, improved interconnect technologies, and advanced packaging techniques, driving continued market growth and adoption.

Intensifying competition among key players in the HBM chip market, including SK Hynix, Micron, and Samsung Electronics, is expected to foster innovation and drive technological advancements.

Final Thoughts

The soaring demand for high-bandwidth memory chips, fueled by the rapid expansion of artificial intelligence services, underscores the pivotal role of semiconductor technology in shaping the future of computing.

As evidenced by SK Hynix’s announcement of the near-complete depletion of HBM chip inventory for 2024 and the projected scarcity for 2025, the semiconductor industry is at a critical juncture marked by escalating demand and technological advancement.

The industry’s response to this unprecedented demand is characterized by strategic investments, technological innovation, and intensified competition among key players.

SK Hynix’s introduction of its latest 12-layer HBM3E chip, along with the plans of competitors like Micron and Samsung Electronics to produce their own advanced HBM chips, reflects a concerted effort to meet the evolving needs of AI infrastructure.

Projections suggest continued growth in demand for HBM chips, driven by the relentless expansion of AI applications across diverse sectors.

Annual demand growth rates of approximately 60% in the mid-to-long term underscore the profound impact of AI on the semiconductor market and the critical role of HBM chips in enabling AI innovation.

As the industry charts its course towards the future, it must navigate challenges such as supply chain constraints, technological barriers, and market volatility.

With strategic investments, collaborative partnerships, and a relentless commitment to innovation, the semiconductor industry is poised to meet the growing demands of AI-driven computing and usher in a new era of technological advancement.